Effective 12/03/2025

1. While Concorde offers these resources at below general market prices, these prices are subject to change based on market conditions beyond the control of Concorde. There may be certain situations when you may be able to purchase some of these items elsewhere from outside sources at a reduced cost. Students have the right to opt out of purchasing certain items from Concorde as long as they are able to obtain these resources prior to course start. A student’s account will not be charged for any item the student chooses to purchase on their own. A list of books and supplies associated with your program of study can be found on the Concorde website (www.concorde.edu). A hard copy can be obtained from the campus upon request.

2. The State of California established the Student Tuition Recovery Fund (STRF) to relieve or mitigate economic loss suffered by a student in an educational program at a qualifying institution, who is or was a California resident while enrolled, or was enrolled in a residency program, if the student enrolled in the institution, prepaid tuition, and suffered an economic loss. Unless relieved of the obligation to do so, you must pay the state-imposed assessment for the STRF, or it must be paid on your behalf, if you are a student in an educational program, who is a California resident, or are enrolled in a residency program, and prepay all or part of your tuition.

You are not eligible for protection from the STRF and you are not required to pay the STRF assessment, if you are not a California resident, or are not enrolled in a residency program.

It is important that you keep copies of your enrollment agreement, financial aid documents, receipts, or any other information that documents the amount paid to the school. Questions regarding the STRF may be directed to the Bureau for Private Postsecondary Education, 1747 N. Market Blvd., Suite 225, Sacramento, CA 95834, (916) 431-6959 or (888) 370-7589.

To be eligible for STRF, you must be a California resident or are enrolled in a residency program, prepaid tuition, paid or deemed to have paid the STRF assessment, and suffered an economic loss as a result of any of the following:

- The institution, a location of the institution, or an educational program offered by the institution was closed or discontinued, and you did not choose to participate in a teach-out plan approved by the Bureau or did not complete a chosen teach-out plan approved by the Bureau.

- You were enrolled at an institution or a location of the institution within the 120 day period before the closure of the institution or location of the institution, or were enrolled in an educational program within the 120 day period before the program was discontinued.

- You were enrolled at an institution or a location of the institution more than 120 days before the closure of the institution or location of the institution, in an educational program offered by the institution as to which the Bureau determined there was a significant decline in the quality or value of the program more than 120 days before closure.

- The institution has been ordered to pay a refund by the Bureau but has failed to do so.

- The institution has failed to pay or reimburse loan proceeds under a federal student loan program as required by law, or has failed to pay or reimburse proceeds received by the institution in excess of tuition and other costs.

- You have been awarded restitution, a refund, or other monetary award by an arbitrator or court, based on a violation of this chapter by an institution or representative of an institution, but have been unable to collect the award from the institution.

- You sought legal counsel that resulted in the cancellation of one or more of your student loans and have an invoice for services rendered and evidence of the cancellation of the student loan or loans.

To qualify for STRF reimbursement, the application must be received within four (4) years from the date of the action or event that made the student eligible for recovery from STRF.

A student whose loan is revived by a loan holder or debt collector after a period of noncollection may, at any time, file a written application for recovery from STRF for the debt that would have otherwise been eligible for recovery. If it has been more than four (4) years since the action or event that made the student eligible, the student must have filed a written application for recovery within the original four (4) year period, unless the period has been extended by another act of law.

However, no claim can be paid to any student without a social security number or a taxpayer identification number.

3. Application Fee of $100.00 is required for this program. This fee is not part of the total program cost and is not refundable.

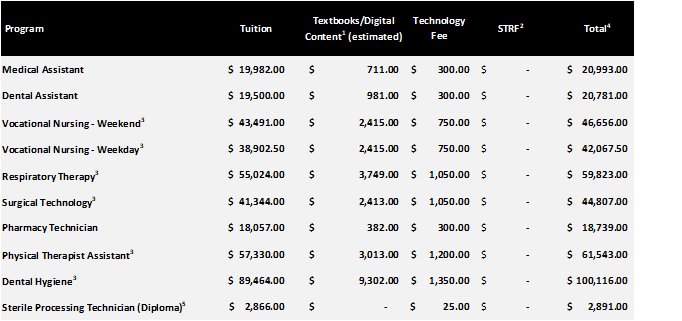

4. Total charges for a period of attendance and schedule for total charges for the entire educational program.

5. This program is not eligible for any Federal Financial Aid or VA programs.

INCIDENTAL FEES All incidental fees are the responsibility of the student and must be paid prior to receiving any item. | |

| Additional Diploma | $10.00 |

| *Transcripts are ordered through Parchment | $10.00 |

| Administrative Withdrawal Fee | $10.00 |

| Copies | $0.10/copy |

| Refresher Training | $100.00 |

| **Repetition Fee (per credit hour) | 50% of the cost per credit hour |

| Replacement Student ID Card | $5.00 |

| ***Retest for Waitlist | $60.00 |

| Returned Check Fee | $15.00 |

*Subsequent official transcripts are ordered through Parchment.

**In order to determine the cost per credit hour, divide the amount of tuition stated above by the total number of credit hours in your program.

***Retake fee after passing all HESI cut scores to improve ranking.

Please view fees below:

Digital Official Transcript through Parchment: $7.50

Printed Official Transcript through Parchment:

USPS Shipping: $2.75 + $7.50 = $10.25

USPS International: $5.75 + $7.50 = $13.25

FedEx Domestic: $33.00 + $7.50 = $40.50

FedEx International: $60.00 + $7.50 = $67.50

Cost of Attendance

Your cost of attendance (COA) is an ESTIMATE of the expenses you may encounter while attending Concorde Career College. Your COA includes direct expenses such as tuition and fees, books, course materials supplies, and equipment, and indirect expenses such as living expenses, transportation and other miscellaneous personal expenses associated with your education.

Tuition and direct expenses vary by program and are listed above. The indirect expenses below are based off a monthly average and may be prorated when academic years are shorter or longer. Indirect expenses reflect an average cost of the components that fall within the category. For additional cost of attendance budgets please contact the Financial Aid office.

| Indirect Expenses - With Parents | |

| Food and Housing | $1,315 |

| Transportation | $202 |

| Personal | $460 |

| Indirect Expenses - Off Campus | |

| Food and Housing | $2,528 |

| Transportation | $221 |

| Personal | $563 |